Indian healthcare industry

Healthcare in India caters to a large population with increasing service requirements, however the healthcare delivery mechanisms are currently plagued with several process inefficiencies

Healthcare in India caters to a large population with increasing service requirements, however the healthcare delivery mechanisms are currently plagued with several process inefficiencies

Such inefficiencies create a great opportunity for process consulting and healthcare IT solutions

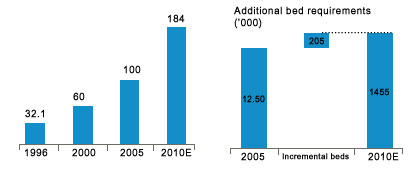

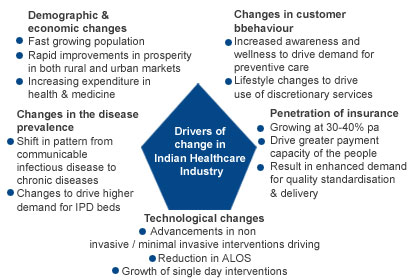

The industry is expected to grow by 13-14% over next 5 years to attain a size of ~ Rs 184,000 cr. by 2010 The curative segment is expected to continue dominate, however preventive and discretionary segments are expect to witness rapid growth

By 2010, India will require ~ 200,000 additional beds (~1000 mid sized nursing homes/ hospitals), majority of which will be captured by the private sector. At an average investment of Rs. 15-25 lakhs per bed, an investment of Rs. 25,000-40,000 crore is needed by 2010

The industry size as a % of GDP has grown from 4.1% of GDP in 1996 to 5.1% in 2005. However, this is still lower than other markets (US -15%, UK- 7%)

Despite the significant growth, the quality of patient care is still poor. Although there is an ecosystem of healthcare delivery, the overall quality of delivery is abysmal.

Typically this has led to poor availability of physicians in the proximity- thus limiting the ability of providing care at the 'golden hour'. The situation is worst in the rural areas, where the nearest PHCs are miles away, with insufficient resources available to the local paramedic. More so, the increasing cost of healthcare has made quality healthcare inaccessible to the masses Overall, this quality is poor largely due to two reasons:

Insufficient infrastructure : There is an overall low number of doctors & specialists per patient, low number of PHCs, Secondary and Tertiary care, low availability of medical equipments and medicine. This lack in infrastructure is largely driven by a large population that is expected to continue until this sector attracts significant investments- both from private as well as public sources

Poor quality of healthcare delivery : Given the poor doctor: patient ratio, doctors find it difficult to give quality time and attention to the patients. At times, the absence of medical records and poor diagnostic facilities leave significant gap in the clinical analysis. Further, there are informal levels of information and clinical data exchange- within the hospital as well between different healthcare centers- leading significant information loss and poor quality of patient care

However these clinical practices are at a cusp of a step change, driven both by demand for better healthcare from patients as well as better service offerings from the hospitals

With increasing income and awareness, patients are demanding better standards in healthcare delivery. Pressure on improvement is also driven by legislative and judicial activism. Increased prevalence of chronic diseases is expected to increase the demand for IPDs and increased preventive healthcare. Further, increased presences of health insurance together with legal cases against negligence are forcing standardization to clinical protocols. Further, on one hand patients are willing to travel to get the services from a specific hospital; hospitals are increasing reach through franchisees to be available 'near the market'

Overall, we see key changes for the healthcare industry:

- Higher customized service levels

- Higher preventive care and increase in 'repeat customers'

- Increased documentation and standardization leading to higher adherence to clinical protocols

- Higher reach of healthcare delivery - 'healthcare on demand'

- Increased pressure on medical practitioners to conduct 'non clinical' activities to support the customer demand

Clearly, we expect an increased thrust on technology and higher IT adoption by the hospitals to manage the new expectations

Download Brochure

Download Brochure Thought Leadership

Thought Leadership Give your Opinion

Give your Opinion